Required Conflicts Disclosures

Connected: Power, data sharing, and bandwidth likely to accelerate

When it comes to connectivity, automakers’ push to create “computers on wheels” with expanded bandwidth and data sharing is likely to go into overdrive.

But in a post COVID-19 world, biometrics (such as eye, facial, or voice recognition) may prove to be a big force of change affecting the industry, as consumers remain cautious about touching or sharing physical controls or screens.

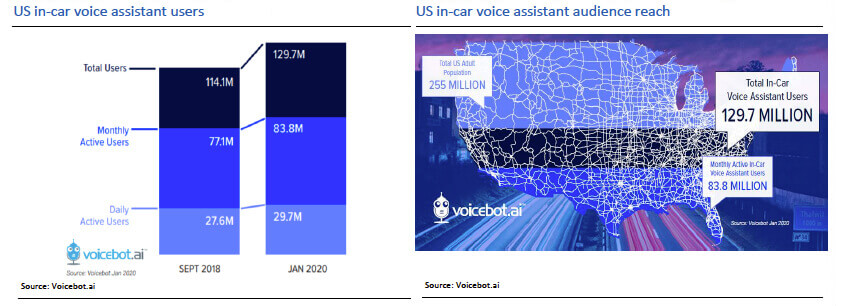

Given this heightened sensitivity, voice assistants—now nearly ubiquitous in mobile and smart home functionalities— will play bigger roles in search, as well as payment authentication, parking, and tolls.

Biometrics may also deliver an opportunity to integrate health monitoring and telemedicine into cars. Autos that can check vital signs and conduct electrocardiograms provide suppliers with ongoing opportunities to generate and monetize consumer data on health, behavior, and geolocation

Autonomous: As capital and resources dry up, development could stall

Once hailed as the great breakthrough for the auto sector and artificial intelligence (AI), autonomous vehicles (AV) may need to adapt its focus due to affordability concerns and scarce capital for technological development.

This decline in AV capital and resources will likely lead to industry consolidation over the next year, as smaller players fold and software providers align with automakers.

Even shared AVs will need to build new business cases. Robo-taxis, once a promising trend for AV development, may suffer from a societal shift away from pooled vehicles.

But amid quarantines and shelter-in place orders, robo-vehicles may also find a new opportunity by facilitating direct dispatch of groceries from stores or warehouses directly to consumers’ homes.

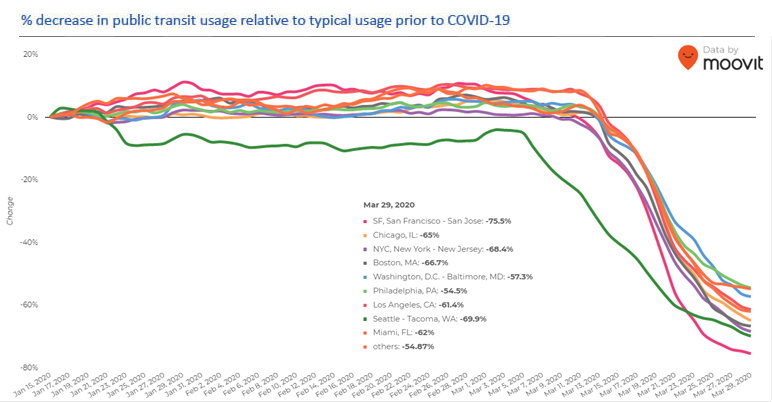

Shared: Aversion to crowded spaces flattens public transportation

Quarantine and isolation orders and avoidance of crowded spaces will deal a hard blow to shared transportation—particularly if viral concerns become a fact of life.

Fueling this challenge is apprehension about riding in taxis, rental cars, or other shared models that may not be properly cleaned between customers.This could be an opportunity for innovation in cleaning solution (autonomous cleaning robots?) or material sciences. If usage drops, so will further investment. Lawmakers may also think twice about proposed infrastructure investments that require sharing.

If COVID-19 negatively impacts societal attitudes towards shared or dense urban areas or if it causes a more permanent shift to work from home, could this lead to an increase in personal vehicle ownership?

Electric: Sales fizzle, but stimulus may ignite long-term use

Over the short term, financially stretched consumers will likely opt for more affordable vehicles over costly, premium EVs. Further, a focus on cash preservation may cause automakers to cut back capex and investments, further delaying new developments and programs.

Over the long-term however, regulation and targeted stimulus plans may spark EV programs in Europe and China, and possibly the U.S.

Plan for behavioral and economic change, but new opportunities

Prolonged economic, social, and behavioral challenges stemming from COVID-19 will put pressure on most auto industry segments, including AVs, public transportation, and electric.

But the pandemic may usher in advancements in cleaning and material sciences. It may also lead to an increase in personally owned vehicles which could create new infrastructure and planning considerations. And, automakers who can seize opportunities to expand voice/facial recognition and other biometrics can ease consumers’ hygiene concerns and benefit from enhanced data sharing possibilities.

Joseph Spak authored the research report “Imagine 2025: Automotive C.A.S.E. in a post COVID-19 era”. For more information about the full report, please contact your RBC sales representative.

For Required Conflicts Disclosures, click here. These disclosures are also available by sending a written request to RBC Capital Markets Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7 or sending an email to rbcinsight@rbccm.com.